Trading in the cryptocurrency market is akin to sailing on an uncharted sea; while the direction is uncertain, there are signs, like the compass of market sentiment on Solana trading, guiding savvy traders toward profitable shores. Understanding these signs is crucial if we are to capitalize on the volatile yet rewarding journey that trading Solana offers. As we delve deeper into market sentiment on Solana trading, you will find compelling reasons why this still nascent cryptocurrency holds the potential for exponential gains, making it a compelling addition to your trading portfolio.

Read Now : Speed Up Solana Node Synchronization

The Growing Influence of Market Sentiment on Solana Trading

The growing influence of market sentiment on Solana trading cannot be overstated. As a traders’ dynamic emotional pulse, market sentiment gauges perceptions and expectations, dictating the psychological state of the market at any given time. This emotional ebullition, often driven by news narratives, expert opinions, and social media hype, influences the decision-making processes of every level of trader—from the most seasoned to the newest novice. For instance, positive sentiment fueled by news of Solana’s technological breakthroughs or partnerships can send its price soaring as optimism feeds into greater buy pressure. Conversely, negative sentiment may trigger a wave of selling as fear and uncertainty spread across trading desks. Therefore, staying attuned to market sentiment on Solana trading becomes an indispensable strategy for traders who wish to exploit these predictable, sentiment-driven price movements, enhancing their chances of staying ahead in the competitive cryptocurrency landscape.

Being knowledgeable about market sentiment on Solana trading also provides a macroeconomic perspective of the cryptocurrency’s potential for growth and its position within the broader digital asset ecosystem. Social media platforms, financial news outlets, and Solana-related forums are treasure troves of sentiment data that offer traders a real-time window into market dynamics, complementing technical and fundamental analyses. By synthesizing this information, traders are better equipped to pinpoint turning points in the market, identify emerging trends, and make calculated moves that maximize return on investment. In today’s fast-paced trading environment, the ability to pivot swiftly based on market sentiment insights can mean the difference between fleeting financial losses and sustained crypto success. Thus, understanding market sentiment on Solana trading is not just a recommendation but a necessity for thriving in the crypto markets.

Key Factors Influencing Market Sentiment on Solana Trading

1. Technological Advancements: Innovative developments within the Solana blockchain regularly sway market sentiment on Solana trading, often inciting optimism and increased trading volumes as investors anticipate enhanced speed and efficiency.

2. Partnerships and Collaborations: High-profile collaborations can significantly bolster market sentiment on Solana trading, creating excitement and prospective gains, as these partnerships often validate Solana’s market presence.

3. Regulatory Developments: Positive or negative regulatory announcements impact market sentiment on Solana trading, as new guidelines can introduce confidence or uncertainty within the market.

4. Market Trends and Events: Overall cryptocurrency market trends, including Bitcoin’s performance, influence market sentiment on Solana trading, given its correlation with broader market movements.

5. Community Engagement: A vibrant and active community can effectively influence market sentiment on Solana trading, driving momentum through engagement, discussion, and promotion across various platforms.

Analyzing Market Sentiment on Solana Trading

Examining the various channels through which market sentiment on Solana trading manifests provides insight into potential market movements. Social platforms like Twitter and Reddit host bustling communities of investors sharing hypotheses and influencing opinions. These exchanges often act as barometers for the prevailing market sentiment on Solana trading, ranging from euphoric anticipation to cautionary pessimism. Not to be overlooked, financial news outlets and expert analyses also inject influential sentiment into the market. Positive forecasts from credible sources or endorsements from influential figures can significantly shape trader attitudes and subsequent price trajectories.

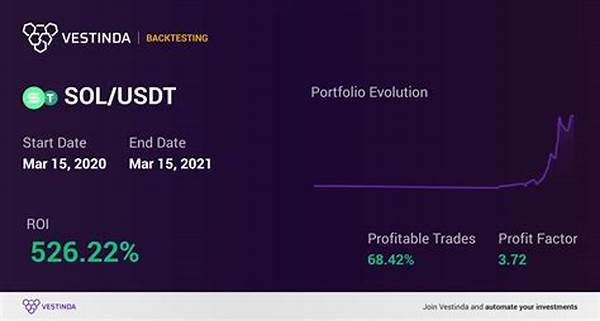

Furthermore, specialized analytics tools provide a quantitative dimension to understanding market sentiment on Solana trading. Metrics such as trading volumes, open interest on exchanges, and sentiment scores derived from natural language processing allow traders to discern the degree of optimism or concern permeating the market. By integrating these varied sentiment indicators, traders create a comprehensive framework for assessing potential price actions. Whether you’re diving into demographic trends or advanced sentiment analysis tools, understanding market sentiment on Solana trading equips you with a nuanced perspective on trading strategies and decision-making, enhancing your ability to forecast and react to price dynamics effectively.

The Power of Market Sentiment Analysis

Market sentiment on Solana trading wields a tremendous influence, often serving as a self-fulfilling prophecy. When the consensus is bullish, traders and investors collectively drive prices higher, further increasing market confidence. Conversely, an overwhelmingly bearish sentiment can lead to drastic sell-offs as traders rush to cut losses. The ability to gauge pervading sentiment before executing trades can hence be a significant competitive advantage.

1. Anticipate Trends: Recognizing shifts in market sentiment on Solana trading positions you to anticipate upcoming market trends and adjust strategies proactively.

2. Risk Management: Identifying negative sentiment early allows traders to implement risk management tactics, such as stop-loss orders, to protect investments.

3. Investment Timing: Proper analysis of sentiment helps in identifying opportune moments to enter or exit the market, ensuring maximum profitability.

4. Adaptability: The dynamic nature of market sentiment on Solana trading calls for flexibility; adjust positions and expectations with changing sentiments.

5. Informed Decisions: Accurate sentiment analysis results in well-informed trading decisions, reducing the likelihood of emotional trading.

Read Now : Choosing A Solana Staking Pool

6. Behavior Predictions: Analyze sentiment to predict how investors might react to news or events, offering a predictive edge.

7. Market Signals: Detecting sentiment shifts can provide early signals of upcoming market volatility or stability.

8. Confidence Building: A solid grasp of market sentiment on Solana trading can bolster trader confidence, fostering a disciplined approach to trading.

9. Trend Identification: Understanding sentiment allows traders to discern emerging trends before they become mainstream, capturing gains early.

10. Strategic Planning: Incorporating sentiment insights into broader trading strategies provides an additional layer of strategic planning.

Navigating Challenges in Market Sentiment on Solana Trading

While market sentiment on Solana trading provides numerous advantages in predicting market direction, it is also fraught with complexities. The highly volatile nature of the cryptocurrency market means that sentiments can shift abruptly, driven by rumors or macroeconomic shifts. As in any speculative endeavor, distinguishing between noise and sentiment-driven market fundamentals is a skill honed over time. Traders must stay vigilant, analytical, and agile, tuning out emotional biases that can distort judgment.

Moreover, the collective sentiment may sometimes lead to irrational price bubbles or escalated fears, leading to market overreaction. Understanding the emotional constituents influencing market sentiment on Solana trading requires constant monitoring and reevaluation. As a safeguard against impulsive decision-making, a diversified strategy that incorporates other analytic methods, such as technical indicators and fundamental analysis, alongside sentiment analysis, is crucial.

In the competitive realm of digital trading, understanding the intricacies of market sentiment on Solana trading is more than a strategic advantage; it’s a prerequisite for success. The volatile nature of cryptocurrencies, compounded by rapid shifts in sentiment, means traders need to be ever-vigilant, adapting their strategies swiftly to stay ahead. Recognizing the power of market sentiment is not just about riding the waves of trends but about anticipating changes before they happen.

Those who succeed in leveraging market sentiment on Solana trading do so by integrating it with technical and fundamental analyses, creating a tri-fold strategy that considers market psychology, historical data, and inherent value propositions. By doing so, traders are equipped to distinguish transient sentiment-driven market movements from sustainable price changes, making informed decisions that encapsulate both caution and bold action. This holistic view ensures that one is not swayed by market hysteria but makes calculated decisions based on a comprehensive understanding of all market elements.

Ultimately, by cultivating an acute awareness of market sentiment on Solana trading, traders can predict potential market directions, mitigate risks, and seize opportunities with precision. Building a robust strategy around this knowledge enables traders to transform volatility from a perceived threat into a calculated ally, turning potential pitfalls into profitable ventures. It is with this understanding that traders not only survive but thrive in the continuously evolving landscape of Solana trading.

The Impact of Market Sentiment on Solana Trading Strategies

Understanding market sentiment on Solana trading is pivotal when formulating trading strategies. It acts as a guide, helping traders identify entry and exit points with greater precision. Yet, the challenge lies in discerning accurate sentiment indicators amidst the noise.

Market sentiment on Solana trading also drives liquidity, affecting how easily trades can be executed. By aligning strategies with prevailing sentiment, traders maximize return potentials, exploiting emotion-driven movements to capture gains. Despite its complexities, a keen grasp of sentiment and its effects empowers traders to navigate the treacherous waters of Solana trading more effectively, ensuring strategies are not just reactive but preemptive and calculated.