In the volatile world of cryptocurrency, understanding the nuances of investor psychology is crucial. Market sentiment, the collective psyche of investors, can drastically influence the trajectory of assets like Solana. This pivotal factor is not just a peripheral concern; it dictates price movements, influences investment strategies, and ultimately shapes Solana’s future. As traders and enthusiasts, staying attuned to market sentiment not only empowers decision-making but also opens a vista of opportunities. Let us delve into how the effects of market sentiment on Solana could potentially transform your investment journey.

Read Now : Windows Guide For Solana Cli

The Role of Emotional Investing

Market sentiment often swings between extremes – greed or fear, euphoria or panic. The effects of these emotional waves on Solana can be profound. When optimism pervades, even minor announcements can lead to surges in Solana’s price, pushed by the frenetic buying of investors looking to capitalize on a bullish wave. Conversely, uncertainty or negative news can trigger a downward spiral, with investors panic-selling, thereby depressing prices. Understanding this emotional undercurrent is paramount for any serious investor. Wouldn’t you want to recognize these trends early and leverage the effects of market sentiment on Solana to your advantage?

Why Solana Investment Requires Sentiment Analysis

1. Sentiment analysis can offer insights into potential price trends, allowing investors to make informed decisions concerning Solana.

2. It helps identify entry and exit points for trades by gauging the effects of market sentiment on Solana.

3. Understanding sentiment dynamics can mitigate risks and minimize losses, offering a strategic edge.

4. Investors can harness positive sentiment to optimize gains in their Solana portfolios.

5. An extensive grasp of market sentiment effects allows for a proactive investment approach, aligning strategies with prevailing trends.

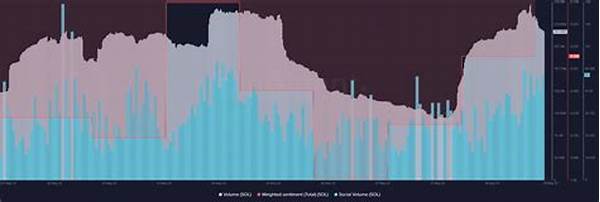

Market Sentiment Indicators and Their Impact

Indicators such as trading volumes, social media buzz, and media publicity stand as beacons for understanding the effects of market sentiment on Solana. These markers signal the prevailing investor mood, helping stakeholders anticipate potential moves. For instance, spiking trading volumes often mirror heightened investor interest or activity, possibly heralding an uptick in Solana’s price. Social media sentiment, rife with bullish or bearish tones, can further magnify or mitigate Solana’s market swings. Maintaining a finger on the pulse of these indicators permits strategic moves that align with observed sentiments.

Read Now : Solana Nft Buying And Selling

Understanding Sentiment-Driven Price Volatility

Recognizing the effects of market sentiment on Solana requires an appreciation of sentiment-driven price volatility. Volatility is not always adverse; it can yield lucrative opportunities for the discerning investor. Engaging in sentiment monitoring can uncover these transitory windows for advantageous trades. Acute sentiment changes manifest visibly in Solana’s price activity, and staying vigilant can mean the difference between substantial profits and regrettable losses. By strategically navigating sentiment-induced volatility, traders position themselves to exploit market inefficiencies to the fullest.

Investor Psychology: The Underpinning of Market Sentiment

Investor psychology, the driver of market sentiment, reveals much about shifts in Solana’s market behavior. Understanding the fear of missing out (FOMO) and other cognitive biases speaks volumes about decision drivers. When investors succumb to herd mentality, they amplify the effects of market sentiment on Solana, causing pronounced price fluctuations. Navigating these psychological elements requires more than understanding graphs and charts; it involves dissecting the collective mindset. An astute investor acknowledges these psychological patterns, using them to predict and capitalize on market changes.

The Ripple Effect of Market Sentiment

While technical and fundamental analyses are cornerstones of trading, sentiment analysis provides insights that fill crucial knowledge gaps. The ripple effect of market sentiment influences not only Solana’s immediate price but also the broader crypto environment. Spikes or slumps in Solana can often be precursors for shifts across similar altcoins, reflecting a broader market echo. By proactively interpreting these ripples, traders gain foresight, positioning themselves strategically to pivot as markets evolve. In essence, mastering market sentiment augments predictive power, transforming uncertainty into opportunity.

Summarizing the Influence of Market Sentiment

In summary, the effects of market sentiment on Solana wield significant influence over its price dynamics and market trends. The emotional underpinnings of the market evoke fluctuations that reflect investor sentiment, allowing those who are perceptive to seize opportunities and evade pitfalls. Emphasizing sentiment analysis alongside traditional analytical methods equips investors with a more holistic understanding of Solana’s market trajectory. Therefore, the committed investor should consistently engage with sentiment trends to harness these insights, ensuring their strategies resonate with the pulse of the market.