In the dynamic world of finance and accounting, few tasks hold as much significance as maintaining synchronized ledgers. In an era where precision and speed are not just advantageous but essential, knowing how to synchronize ledgers correctly can elevate your business practices to new heights. Imagine having the power to eliminate errors, streamline operations, and ensure that every financial decision is backed by accurate, real-time data. The promise of correctly synchronized ledgers isn’t merely about keeping numbers in check; it’s about empowering your decisions and ensuring the sustainable success of your business. As you embark on the journey to mastering this vital process, consider the transformative impact that precise ledger synchronization can have on your professional landscape.

Read Now : “secure Migration Of Sol Environments”

The Importance of Synchronizing Ledgers

Understanding the importance of synchronizing ledgers is the first step to improving your financial accuracy. When done correctly, ledger synchronization can prevent discrepancies that often lead to financial misjudgments and audit failures. Businesses rely on accurate financial data to make informed decisions, and when you know how to synchronize ledgers correctly, you’re safeguarding the integrity of this data. Beyond accuracy, synchronized ledgers ensure efficiency by reducing the time spent on manual reconciliation and allowing your team to focus on more strategic tasks. Moreover, in an era where financial transparency is paramount, having synchronized ledgers enhances trust with stakeholders and regulatory bodies. Thus, mastering how to synchronize ledgers correctly not only fortifies your business operations but also elevates your overall professional reputation.

Steps to Synchronize Ledgers Correctly

1. Establish Clear Protocols: Formulate clear guidelines for data entry to ensure consistency across all ledger entries. Knowing how to synchronize ledgers correctly starts with eliminating inconsistencies.

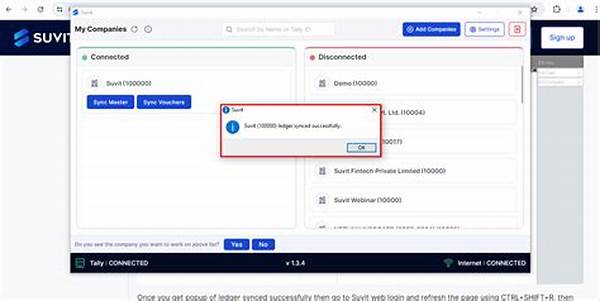

2. Utilize Automation Tools: Invest in financial software that offers real-time updates and synchronization capabilities. These tools can drastically improve accuracy and reliability.

3. Regular Reconciliation: Implement frequent reconciliation checks to identify discrepancies early. Synchronizing ledgers is a continuous process that requires diligence.

4. Centralize Data Access: Implement a centralized system for accessing and updating ledger information. This minimizes the chances of duplicated or incorrect entries.

5. Continuous Training and Evaluation: Regularly train your staff on the synchronization process. Understanding how to synchronize ledgers correctly is essential for everyone involved in financial management.

Benefits of Correct Ledger Synchronization

The benefits of accurately synchronizing your ledgers extend far beyond just balancing the books. When you know how to synchronize ledgers correctly, you are bringing efficiency and accuracy to the foundation of your business operations. Synchronized ledgers lead to timely financial reporting, helping you navigate quick decision-making processes with ease and confidence. Additionally, they provide a transparent audit trail, crucial for establishing the credibility of your financial statements. This transparency reduces the risk of fraud and strengthens trust with external auditors, investors, and stakeholders. Furthermore, accurate ledger synchronization reduces redundant tasks, freeing up valuable resources and allowing your team to allocate efforts toward strategic initiatives. By investing in processes that focus on how to synchronize ledgers correctly, you lay the groundwork for a robust and proactive financial strategy.

Common Pitfalls in Ledger Synchronization

1. Inconsistent Data Entry: Inconsistencies in data entry undermine the synchronization process. Knowing how to synchronize ledgers correctly involves standardizing entry formats.

2. Lack of Timely Updates: Delayed updates can lead to inaccurate financial statements. Stay on top of updates to ensure ledgers reflect current data accurately.

3. Over-reliance on Manual Processes: Manual processes are prone to human error. Embrace technological solutions to execute synchronization with precision.

4. Ignoring Reconciliation Benefits: Frequent reconciliation might seem tedious, but it’s essential for identifying and rectifying errors promptly.

5. Neglecting System Compatibility: Ensure all financial systems and software are compatible to avoid synchronization issues.

6. Underestimating the Role of Training: Workforce training is crucial in understanding how to synchronize ledgers correctly and efficiently.

Read Now : Cybersecurity Tools For Solana Developers

7. Poor Communication among Teams: Ensure open communication channels about ledger updates to avoid discrepancies and overlaps.

8. Non-Compliance with Regulations: Ledger synchronization should adhere to industry regulations and standards to avoid legal pitfalls.

9. Failure to Monitor Changes: Keep track of all changes in ledger data to maintain the accuracy and integrity of financial records.

10. Lack of Leadership in Financial Strategy: Leadership should advocate for best practices in synchronization to underscore its importance.

Implementing a Seamless Ledger Synchronization Process

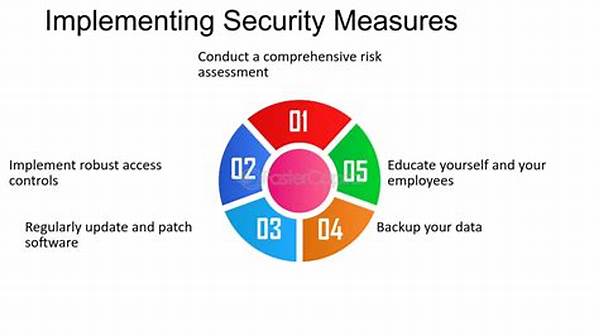

Creating a seamless process for ledger synchronization is essential for businesses aiming to enhance operational efficiency. Initially, businesses should focus on establishing a robust framework for data management that prioritizes consistency and standardization. The journey of learning how to synchronize ledgers correctly begins with ensuring that all staff are aligned with the best practices, emphasizing accuracy and timeliness in every financial action. Training and workshops can further deepen the understanding, enabling employees to recognize the value of synchronization in achieving broader organizational goals. Encouraging a culture of continuous improvement and technological adaptation will keep your synchronization efforts relevant and efficient, directly contributing to a stronger financial foundation.

Moreover, integrating modern technological solutions is critical in achieving effective ledger synchronization. Automation tools that offer real-time data integration and error-checking capabilities greatly assist in maintaining accurate financial records. When businesses optimize their processes through technology, they minimize the risk of human errors and significantly improve operational efficiency. With a firm grasp on how to synchronize ledgers correctly, companies can capitalize on sustainable growth while confidently navigating complex financial landscapes. Ultimately, by prioritizing seamless ledger synchronization, you not only secure your financial integrity but also promote a culture of trust and excellence within your organization.

Techniques and Tools for Correct Ledger Synchronization

For successful ledger synchronization, employing the right techniques and tools is crucial. First, utilizing advanced accounting software designed for automated ledger management can eliminate discrepancies due to human error. Understanding how to synchronize ledgers correctly can be vastly simplified through such technologies. Additionally, establishing regular review systems ensures that records are consistently matched across departments, providing a comprehensive overview of financial health. Implementing cloud-based solutions also facilitates real-time updates and accessibility, enabling prompt decision-making informed by accurate data. Regular audits and reconciliations further lock in financial accuracy, ensuring that all entries align perfectly.

In conclusion, by incorporating these strategic techniques and tools, businesses establish a robust environment for maintaining meticulous financial records. Each of these elements plays a vital role in advocating for synchronized systems that echo reliability and precision. By prioritizing these measures, you not only learn how to synchronize ledgers correctly but also set a precedent for financial excellence within the competitive marketplace. The effectiveness of these practices is evident in the strengthened transparency and increased confidence they bring to all organizational financial activities.

Conclusion: The Dedication to Accurate Synchronization

As we embrace the digital age, ensuring the accuracy and synchronization of ledgers has become more critical than ever. The question of how to synchronize ledgers correctly isn’t just about maintaining an organized financial record; it’s about securing the future of your business. The efforts and resources you invest in perfecting this aspect will pay dividends in the long run, providing you with the agility and foresight to navigate and thrive within the complexities of today’s financial markets.

Understanding how to synchronize ledgers correctly necessitates a commitment to continuous improvement and adaptation to new technological advancements. Let this be a call to action—a reminder that accurate ledger synchronization is not merely a task but a strategic initiative integral to your company’s success. By aligning your practices with these principles, you lay the groundwork for a resilient and trustworthy financial system, instilling confidence in your stakeholders and ensuring enduring success.