In today’s rapidly evolving financial landscape, businesses face an increasingly complex web of challenges in managing their liquidity. The ability to predict and manage liquidity effectively can make the difference between prosperity and financial distress. Enter predictive liquidity forecasting models, a groundbreaking tool for financial forecasting that empowers businesses to stay ahead of market fluctuations and ensure financial stability. These models offer a sophisticated blend of data analytics, machine learning, and financial insights, enabling companies to accurately forecast their liquidity needs and optimize cash flow. By embracing these models, businesses not only safeguard their financial health but also seize strategic opportunities that might otherwise be overlooked.

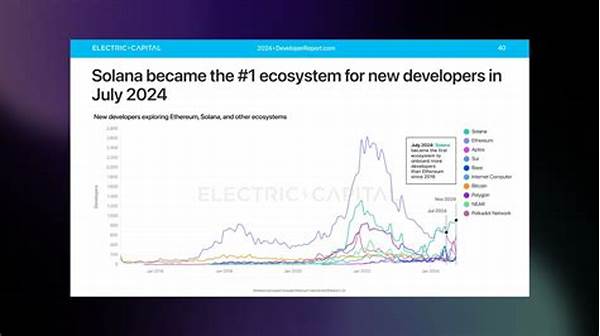

Read Now : Step-by-step Solana Wallet Adjustment

Unlocking Financial Stability Through Predictive Liquidity Forecasting Models

Predictive liquidity forecasting models stand as a beacon of innovation, providing financial analysts and decision-makers with the precision tools they need to predict future cash flows accurately. These models utilize vast amounts of data, both historical and real-time, to generate forecasts that can anticipate changes in financial conditions with remarkable accuracy. Equipped with such insights, businesses are better positioned to navigate potential liquidity crunches, thereby maintaining operational stability and averting crises. Moreover, predictive liquidity forecasting models enable companies to make informed strategic choices, such as investing in growth opportunities or optimizing debt management. The real power of these models lies in their ability to transform uncertainty into actionable intelligence, empowering organizations to operate with a heightened sense of agility and readiness. In an environment where financial missteps can lead to dire consequences, leveraging predictive liquidity forecasting models is not just advisable but imperative.

The Imperative of Predictive Liquidity Forecasting Models for Modern Business

1. Proactive Cash Management: Predictive liquidity forecasting models empower businesses to manage their cash proactively, ensuring they are always financially agile and prepared for any eventuality.

2. Strategic Decision-Making: These models offer invaluable insights that inform strategic decision-making, allowing companies to align their financial strategies with long-term objectives confidently.

3. Risk Mitigation: By forecasting potential liquidity shortfalls, predictive liquidity forecasting models help businesses mitigate financial risks and avert potential crises.

4. Enhanced Financial Planning: With predictive liquidity forecasting models, businesses can plan their financial futures more effectively, aligning resource allocation with expected cash flow patterns.

5. Competitive Advantage: Organizations that utilize predictive liquidity forecasting models gain a competitive edge by optimizing liquidity management and capitalizing on market opportunities swiftly.

Transforming Financial Landscapes with Predictive Liquidity Forecasting Models

The financial realm is not immune to the winds of change, and predictive liquidity forecasting models are at the forefront of this transformation. These models are revolutionizing how businesses perceive and manage their financial futures. They enable companies to harness the power of data analytics to anticipate and react to financial dynamics that were previously challenging to foresee. By leveraging predictive liquidity forecasting models, organizations can transition from reactive to proactive liquidity management, which speaks to better capital control and aligned financial strategies with organizational goals. Furthermore, these models instill a culture of precision and planning, fostering confidence among stakeholders about the company’s financial roadmap. In a world where financial efficiency is paramount, adopting these models equips businesses with the foresight needed to thrive in competitive environments.

The Strategic Edge Offered by Predictive Liquidity Forecasting Models

1. Real-Time Insights: Predictive liquidity forecasting models provide real-time insights, enabling businesses to make timely decisions that align with shifting market dynamics.

2. Precision Forecasting: They offer precision in forecasting, ensuring financial plans are both accurate and adaptable to various market scenarios.

3. Data-Driven Decisions: These models utilize comprehensive data analytics, transforming raw information into actionable insights that guide financial strategy.

4. Resilience Building: By predicting liquidity needs, these models help build financial resilience, preparing businesses for unforeseen economic challenges.

5. Operational Optimization: The clarity provided by predictive liquidity forecasting models optimizes operational decisions, enhancing overall business performance.

Read Now : Evaluating Validator Performance Metrics

6. Cost Efficiency: Through accurate forecasts, companies can optimize their resource allocation, leading to significant cost savings.

7. Improved Cash Flow Management: Businesses can better manage cash flows, ensuring financial obligations are met without disrupting operations.

8. Market Anticipation: By predicting market trends, these models help organizations anticipate and prepare for economic shifts.

9. Strategic Resource Allocation: Predictive insights allow for strategic resource allocation that aligns with business priorities.

10. Financial Agility: Ultimately, these models provide the financial agility needed to navigate ever-evolving markets effectively.

The Dynamics of Business Success with Predictive Liquidity Forecasting Models

Predictive liquidity forecasting models offer businesses a transformative edge in an era where financial agility and strategic foresight are imperative. Imagine a world where every financial decision is backed by robust data-driven insights, forging pathways to success. By leveraging these advanced models, companies can predict potential liquidity bottlenecks before they hinder operations, ensuring a seamless flow of capital. These models act like a financial compass, guiding businesses through turbulent market waters with precision and confidence. As companies continue to navigate a future filled with uncertainty, the use of predictive liquidity forecasting models becomes a key differentiator in achieving sustained growth. They empower organizations to focus on innovation and expansion by minimizing the risks associated with liquidity management. In essence, predictive liquidity forecasting models not only preserve financial health but also become catalysts for growth in a highly competitive market landscape.

The Future of Finance with Predictive Liquidity Forecasting Models

As we venture further into the digital age, the role of predictive liquidity forecasting models in shaping successful business practices cannot be overstated. These models are increasingly becoming integral to how organizations strategize and execute their financial plans. By unlocking the potential to forecast financial conditions accurately, businesses can confidently steer their activities toward achieving strategic goals without being blindsided by unforeseen liquidity challenges. As the pace of innovation accelerates and market uncertainties heighten, predictive liquidity forecasting models remain the cornerstone of effective financial management. Companies equipped with these models are well-positioned to navigate future challenges, capitalizing on opportunities with unparalleled efficiency and effectiveness. They stand ready to transform financial landscapes, shaping the future of finance into one characterized by predictability, resilience, and strategic acumen.

The Empowering Role of Predictive Liquidity Forecasting Models

Predictive liquidity forecasting models empower businesses with the foresight necessary to thrive in today’s dynamic financial environment. As financial complexities deepen, utilizing these models turns potential uncertainties into strategic advantages. They offer a level of preparedness that not only assures stakeholders but also aligns with ambitious growth trajectories.

The Strategic Importance of Predictive Liquidity Forecasting Models

In summary, predictive liquidity forecasting models stand as essential pillars in the financial strategies of modern businesses. Their ability to transform data into actionable insights is unparalleled, forging paths to informed decision-making and strategic financial planning. As companies face an increasingly dynamic market landscape, these models offer a blueprint for navigating challenges with precision. By embracing predictive liquidity forecasting models, organizations gain not just an operational advantage but also position themselves as leaders in innovation and strategic finance management. Consequently, adopting such models is a decisive step toward sustainable business success, ensuring longevity and competitive prowess in ever-evolving economic climates.