In the fast-paced world of cryptocurrency, every transaction carries an inherent risk. But when it comes to Solana transactions, the stakes are uniquely high due to the platform’s rapid transaction speeds and innovative technology. Imagine being able to confidently navigate this space without fear of loss or error. Through effective risk management for Solana transactions, you can turn this vision into reality. By understanding potential pitfalls and proactively addressing them, you not only protect your assets but also maximize your gains. Don’t let uncertainty hold you back. Embrace the strategic advantage of being prepared.

Read Now : Solana Network Scalability Issues

The Importance of Risk Management for Solana Transactions

As Solana continues to redefine the world of cryptocurrency with its groundbreaking infrastructure, risk management for Solana transactions becomes crucial. Engaging with a network capable of processing thousands of transactions per second presents both opportunities and risks. The speed and efficiency of Solana can lead to unprecedented growth, but it’s accompanied by potential vulnerabilities that can’t be ignored.

Effective risk management for Solana transactions involves identifying these vulnerabilities, like system glitches or potential security breaches, and developing strategies to mitigate them. By doing so, investors and users can make informed decisions, reducing potential losses. Proactively managing risks also instills confidence in users, encouraging more interaction within the Solana network. With market volatility being a constant hurdle, mastering risk management ensures that your cryptocurrency journey is both secure and profitable.

Embracing risk management isn’t just a choice; it’s a necessity. As Solana sets new benchmarks in transaction capability, the responsibility lies with each participant to safeguard their digital assets. Implementing robust risk management strategies enables you to navigate Solana transactions with assurance, turning potential threats into opportunities for growth. Let your engagement with Solana be marked by security and success, achieved through diligent risk management practices.

Strategies for Effective Risk Management for Solana Transactions

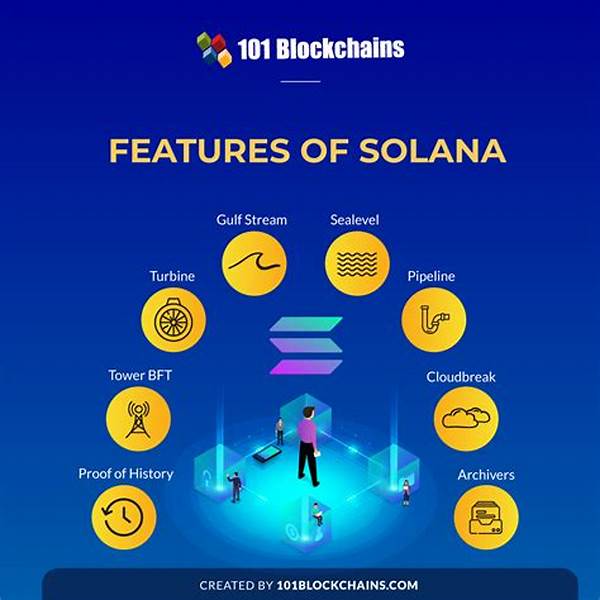

1. Understand the Ecosystem: Gaining knowledge about Solana’s network intricacies allows for effective risk management for Solana transactions. Understanding how the technology works can help identify potential vulnerabilities.

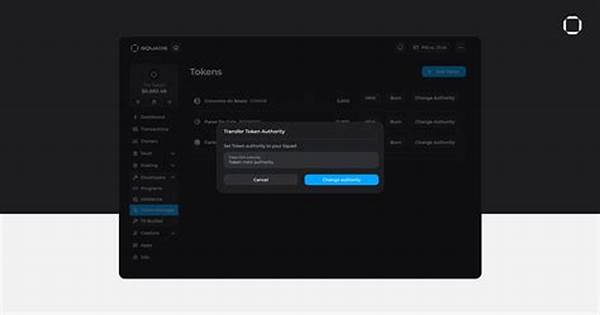

2. Utilize Secure Wallets: Choose wallets with robust security features for storing your assets, ensuring that risk management for Solana transactions extends to safeguarding your holdings against hacking.

3. Stay Informed About Updates: Keeping up with Solana’s developments and updates aids in risk management for Solana transactions by alerting users to necessary changes in their approaches.

4. Assessment of Market Trends: Regularly assessing market trends and potential disruptions helps in recalibrating your risk management for Solana transactions, ensuring you are always prepared for market shifts.

5. Diversify Holdings: Don’t put all your eggs in one basket. Diversification is a key component of risk management for Solana transactions, reducing exposure to potential losses.

Challenges in Risk Management for Solana Transactions

As Solana’s popularity surges, so too do the challenges in implementing effective risk management for Solana transactions. One major obstacle is the constant evolution and complexity of its technology. With rapid development cycles, staying ahead becomes daunting for users striving to maintain effective risk management.

Moreover, the volatile nature of the crypto market adds an unpredictable layer to risk management for Solana transactions. Price fluctuations can be drastic, and without careful planning and mitigation strategies, these can lead to significant financial setbacks. Therefore, it is crucial to develop dynamic strategies that adapt to these changes, ensuring assets remain safeguarded.

Lastly, the threat of cyber attacks looms large. As a thriving network, Solana attracts hackers seeking vulnerabilities within its systems. By implementing robust security measures and maintaining vigilance, risk management for Solana transactions can mitigate the impacts of such threats. It’s imperative to remain proactive and informed, constantly updating strategies to counteract emerging risks.

Benefits of Proactive Risk Management for Solana Transactions

1. Enhanced Security: Strengthening security measures reduces vulnerability to cyber threats and builds trust among users.

2. Financial Stability: Through careful planning, risk management for Solana transactions ensures financial assets remain protected from market volatility.

3. Increased Confidence: A proactive approach instills confidence, encouraging more active participation within Solana’s ecosystem.

4. Long-term Success: Implementing risk management strategies lays the foundation for sustained and safe growth in the Solana network.

Read Now : “nft Marketplace Future Developments”

5. Adaptability: Staying informed and responsive to changes enables swift adjustments to risk management strategies, safeguarding assets.

6. Reputation Management: Effective management of potential risks enhances reputational value across the blockchain community.

7. Market Awareness: Understanding current trends and forecasting future ones provides insights for better decision-making.

8. Regulatory Compliance: Awareness and adherence to regulations prevent legal complications, aligning practices with global standards.

9. Operational Efficiency: Streamlined processes and risk assessments lead to a more efficient transaction environment.

10. Competitive Advantage: A robust risk management strategy sets participants apart, positioning them favorably within the market.

Why Risk Management for Solana Transactions is Essential

Navigating the dynamic landscape of Solana transactions demands more than just basic understanding; it requires comprehensive risk management for Solana transactions. This framework ensures a robust defense against unexpected challenges that could arise within the crypto realm. The absence of effective risk management strategies could lead to not only financial losses but also undermine user confidence.

Firstly, the incorporation of risk management practices secures your assets and prepares you for unpredictable market conditions. By evaluating potential threats and implementing preventive measures, you transform possible vulnerabilities into opportunities. This proactive stance offers peace of mind and encourages active participation in the network.

Moreover, the competitive advantage gained through risk management for Solana transactions is invaluable. As the ecosystem continues to grow and evolve, those with established risk management protocols will stand out, attracting more engagement and investment. Position yourself at the forefront by demonstrating understanding and capability in managing risks.

Lastly, nurturing a culture of risk management within the Solana community contributes to its overall stability and growth. Participants collaborating on security and efficiency pave the way for a resilient and thriving ecosystem. In embracing and promoting these practices, you align yourself with the best interests of the network, promoting long-term sustainability and success.

Conclusion on Risk Management for Solana Transactions

Embracing comprehensive risk management for Solana transactions is not merely advisable; it’s essential. As Solana continues to set benchmarks in the crypto world, ensuring that each transaction is backed by diligent risk assessment and mitigation strategies becomes paramount. This approach not only protects individual investments but contributes to the broader health of the cryptocurrency ecosystem.

In conclusion, risk management for Solana transactions empowers users to navigate the complexities of the digital finance landscape with confidence and security. By prioritizing this aspect of your investment approach, you ensure resilience against market volatility, safeguard against unforeseen threats, and position yourself for long-term success. The future of cryptocurrency is exciting and full of potential—make sure you’re ready to thrive in it by mastering risk management today.