The intriguing saga of Solana in the cryptocurrency world is nothing short of captivating. As one of the most promising digital assets, it has witnessed both exhilarating highs and perplexing lows. For anyone invested or considering investing in Solana, understanding its dynamic market behavior is crucial. Navigating the Solana gains and losses examination is not merely an academic exercise—it’s a strategy for potential success. By examining its past and current trends, you can make informed decisions that might put you ahead of the curve.

Read Now : High-speed Transactions For Nfts

Understanding Solana: An In-Depth Review

Solana’s journey in the crypto market is a tale of resilience and innovation. As a blockchain platform known for its high throughput and low transaction costs, Solana has captured the attention of developers and investors alike. Yet, like any volatile asset, it has experienced dramatic fluctuations. The Solana gains and losses examination reveals that these fluctuations are not arbitrary. Instead, they stem from various market forces, including technological advancements, regulatory news, and broader economic trends. By diving deep into these elements, you gain insights that enhance your investment strategies. The fluctuating values highlight the importance of a well-rounded understanding before making any financial commitments in the crypto realm.

Key Factors in Solana’s Market Volatility

1. Market Sentiment: Solana gains and losses examination are often driven by investor sentiment, which can shift rapidly based on news and global economic factors.

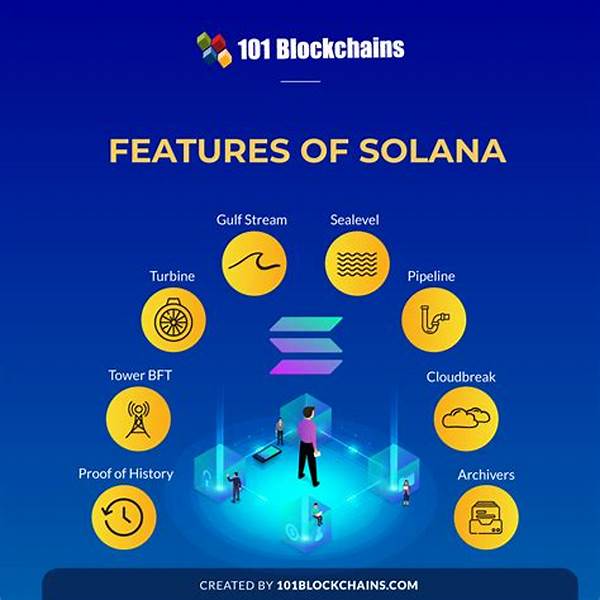

2. Development Milestones: Successful implementation of new technologies within the Solana network plays a significant role in its market performance, as shown in the Solana gains and losses examination.

3. Competitive Landscape: With competitive altcoins emerging, Solana gains and losses examination must account for how its rivals are evolving and impacting its market position.

4. Regulatory Changes: Changes in regulations across key markets can significantly influence Solana gains and losses examination, affecting its accessibility and investor trust.

5. Security Concerns: Confidence in Solana’s security infrastructure is vital. Solana gains and losses examination highlight how security breaches can impact investor decisions.

Strategies for Analyzing Solana Gains and Losses

When embarking on a Solana gains and losses examination, it’s important to consider both short-term blips and long-term trends. Recognizing patterns requires a discerning eye and staying informed about market developments. Engaging with credible news sources and analysis can empower you to pinpoint opportunities for profitable entry and exit. Furthermore, analyzing Solana’s technical blockchain enhancements and their reception among developers can provide clues about future market directions. Thoroughly understanding these elements ensures you’re not just reacting to market movements but proactively positioning yourself to benefit from inevitable fluctuations.

Read Now : Adjusting Solana Wallet Privacy Settings

Deep Dive: Technical Analysis and Market Sentiment

Delving deeper into Solana gains and losses examination, it’s essential to integrate both technical analysis and market sentiment. Technical analysis utilizes historical data and trading volumes to predict future movements, providing a framework for understanding price trends. Meanwhile, market sentiment refers to the overall attitude of investors towards Solana. Factors such as news events, social media trends, and expert opinions contribute significantly to market sentiment. Balancing these approaches allows investors to make informed decisions, ensuring that Solana’s past missteps become future opportunities. Consequently, a strategic solana gains and losses examination should always consider these dual aspects.

The Importance of Continuous Monitoring

In the fast-evolving crypto world, continuous monitoring of Solana’s performance is indispensable. Regularly conducting a solana gains and losses examination gives investors the agility to adapt to the market’s rapid shifts. This vigilance does more than just safeguard against losses; it also allows investors to capitalize on unforeseen opportunities. By staying informed and agile, you position yourself to not merely weather the storms of volatility but to thrive amidst them. An ongoing solana gains and losses examination, framed with discipline and prudence, can illuminate pathways to consistent growth in your investment journey.

Comparative Analysis with Other Cryptos

Within the broader crypto market context, solana gains and losses examination shines light on how it fares compared to its contemporaries. Investors can draw meaningful insights by contrasting Solana’s performance with that of Bitcoin, Ethereum, and other major cryptocurrencies. Such an analysis highlights Solana’s unique strengths and potential vulnerabilities. Understanding these comparative metrics equips investors with strategic knowledge, aiding in crafting diversified portfolios that mitigate risk while maximizing potential returns. Embracing Solana’s comparative position in the crypto ecosystem is vital for any serious investor’s strategy.

Concluding Thoughts on Solana Gains and Losses Examination

In conclusion, the solana gains and losses examination is a critical exercise for both current and potential investors. This process aids in better understanding the complex market landscape, informing decisions that align with one’s financial goals. While market volatility may seem daunting, it equally provides opportunities for growth and profit when navigated wisely. With meticulous analysis, a forward-thinking mindset, and a willingness to adapt, investors can harness the insights gained from the solana gains and losses examination to refine their strategies and confidently traverse the ever-changing crypto market landscape.