In today’s rapidly evolving cryptocurrency landscape, understanding the reasons behind the fluctuations in Total Value Locked (TVL) on Solana can be the key to making informed investment decisions. By analyzing Solana TVL fluctuations, investors and crypto enthusiasts can gain valuable insights into the DeFi market dynamics, enabling them to act decisively and strategically. As market trends shift, a keen understanding of these movements can provide a significant edge, leading to better returns and minimized risks.

Read Now : Solana Blockchain Development Projects

Understanding TVL on Solana

As a pioneer in the blockchain ecosystem, Solana stands out for its unique combination of fast transaction speeds and low costs. However, observing how its TVL fluctuates can reveal much about its current state and future potential. Analyzing Solana TVL fluctuations involves examining the inflows and outflows of capital within its protocols, which in turn reflects investor confidence and market health. By focusing on these movements, stakeholders can predict potential trends, aligning their strategies with market opportunities.

The process of analyzing Solana TVL fluctuations provides more than just raw data—it offers a lens into the broader market sentiment. When TVL rises, it indicates growing trust among users and investors, potentially leading to a bull market. Conversely, a decline might suggest caution or a shift in investment preferences. Therefore, understanding these fluctuations is not merely an analytical exercise but a tactical tool for navigating the crypto waters effectively.

Key Factors Influencing Solana TVL

1. Market Sentiment: By analyzing Solana TVL fluctuations, one can assess the prevailing market sentiment. Positive sentiment usually results in increased TVL as more investors participate in the network.

2. Technological Upgrades: Innovations and improvements in Solana’s infrastructure can significantly impact TVL. Observing these changes helps in predicting fluctuations.

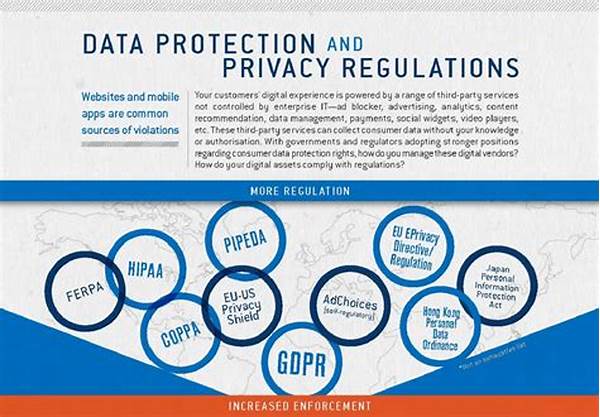

3. Regulatory Changes: New regulations can either bolster confidence or create uncertainty. Analyzing Solana TVL fluctuations helps gauge the impact of these regulatory factors.

4. Competitive Developments: The rise or fall of competitors can influence Solana’s TVL. By monitoring these dynamics, stakeholders can better understand market trajectories.

5. Economic Indicators: External economic factors, such as changes in interest rates, can affect capital flows into Solana’s ecosystem. Analyzing these can provide a holistic view of TVL changes.

Importance of TVL Analysis for Investors

For investors, analyzing Solana TVL fluctuations is crucial not only for gauging market stability but also for identifying lucrative opportunities. With the crypto market’s inherent volatility, having a robust understanding of TVL movements can significantly reduce investment risks. By detecting early signs of growth or decline, investors are better positioned to adjust their portfolios proactively, reducing potential losses and capitalizing on emerging trends.

The potential of analyzing Solana TVL fluctuations extends beyond merely spotting opportunities. It empowers investors to align their strategies with broader market cycles, maximizing returns while minimizing exposure to downturns. By interpreting these fluctuations through the lens of strategic investment, one can foster resilience and agility in navigating the dynamic world of cryptocurrency.

Read Now : Software Certification And Job Opportunities

The Role of Data in Understanding TVL

Effective analysis of Solana TVL fluctuations relies heavily on the availability and reliability of data. Accurate data helps investors discern patterns, identify anomalies, and make data-driven decisions. By leveraging real-time analytics and historical data, stakeholders can paint a comprehensive picture of Solana’s market health, guiding informed actions based on solid evidence.

Analyzing Solana TVL fluctuations also enables the prediction of future trends, as data reveals the trajectory of investment flows and user activity. Accurate and timely information arms investors with the tools they need to anticipate market shifts before they happen. Therefore, having access to high-quality data is paramount for those looking to maintain a competitive edge in this rapidly changing industry.

The Future of Solana TVL Analysis

As the blockchain industry continues to evolve, the practice of analyzing Solana TVL fluctuations will become increasingly sophisticated. With advancements in AI and machine learning, predicting TVL trends will become more precise, enabling investors to respond more swiftly to market changes. As a result, those who dedicate time to understanding these fluctuations will be better equipped to navigate the complexities of decentralized finance.

In conclusion, the insights gained from analyzing Solana TVL fluctuations provide significant strategic advantages. As technology and market dynamics progress, the ability to effectively interpret these fluctuations will be crucial for success. By embracing this analytical approach, investors and developers alike will find themselves better positioned to thrive in the ever-expanding world of blockchain technology.

Conclusion: Mastering the Art of TVL Analysis

By delving into the intricacies of Solana’s TVL fluctuations, one gains access to critical insights that can shape strategic decisions. This analysis empowers investors with knowledge, reducing uncertainty in navigating the volatile cryptocurrency market. As more stakeholders recognize its importance, analyzing Solana TVL fluctuations will remain a pivotal aspect of successful investment strategies.

Analyzing Solana TVL fluctuations, therefore, is not merely an exercise in number-crunching—it’s a powerful tool that offers foresight and strategic advantage. With a growing community of users and developers rallying around Solana, understanding its TVL dynamics is becoming an essential skill in navigating the future of finance.