In today’s rapidly evolving digital world, cryptocurrencies have emerged as a revolutionary force transforming the financial landscape. However, one critical aspect often overlooked is the transaction fees associated with cryptocurrency wallets. As users seek efficiency, understanding and managing these fees can be a game-changer in maximizing profits and minimizing costs. Now is the time to delve deeper into this crucial component, ensuring that you’re making the most informed decisions in your digital currency transactions.

Read Now : Troubleshooting Solana Cli Setup

Understanding Cryptocurrency Transaction Fees in Wallets

Cryptocurrency transaction fees in wallets can vary greatly, and they have a profound impact on the overall user experience and the efficiency of transactions. When it comes to transferring digital assets, these fees can often be the deciding factor in how and when transactions are executed. The fees serve not only as a reward for miners who validate transactions but also as a mechanism to regulate network traffic and prioritize transactions. With the increasing popularity of cryptocurrencies, managing these fees effectively has become more important than ever.

Adopting strategies to optimize cryptocurrency transaction fees in wallets is essential for anyone who regularly deals in digital assets. The right approach can save both time and money, allowing for greater flexibility and control over your investments. As blockchain networks become busier, ensuring your transactions are processed smoothly can often come down to how well you navigate the fee structures. By gaining a deeper understanding of these fees and their implications, users are better positioned to make savvy financial decisions.

Moreover, in the world of instant gratification and real-time processing, the impatience of waiting for a transaction to confirm can be frustrating. High fees can often expedite this process, but at what cost? By intelligently applying knowledge about cryptocurrency transaction fees in wallets, one can strike a balance between cost and efficiency, making sure that each transaction aligns with one’s financial goals and expectations.

The Importance of Optimizing Your Fees

Optimizing cryptocurrency transaction fees in wallets is not just a financial benefit, but a strategic move. As transaction volume increases, so does the competition for miners’ attention, potentially causing delays. Ensuring that your fees are appropriately set can lead to faster and more reliable transaction confirmations, essential for efficient digital currency management.

High transaction fees can eat into your profits, especially if you’re dealing in small amounts. By understanding and managing cryptocurrency transaction fees in wallets, you can strategically plan your transactions to coincide with lower network activity periods, saving significant costs.

Informed decisions about cryptocurrency transaction fees in wallets can significantly impact your overall investment success. By staying educated on how these fees fluctuate, you can avoid unnecessary costs and make smarter, more profitable investments in the long run.

When choosing a wallet, considering its fee structure is vital. Different wallets have varying methods for calculating fees, and understanding these can help you select one that aligns with your transaction frequency and amount, ultimately ensuring more cost-effective dealings.

Reducing cryptocurrency transaction fees in wallets by selecting efficient fee algorithms can ensure you’re not overpaying for transactions. Minimizing these fees effectively increases your net gains, as every penny saved is a penny earned, making it a crucial area for cryptocurrency enthusiasts to focus on.

Strategies to Minimize Cryptocurrency Transaction Fees in Wallets

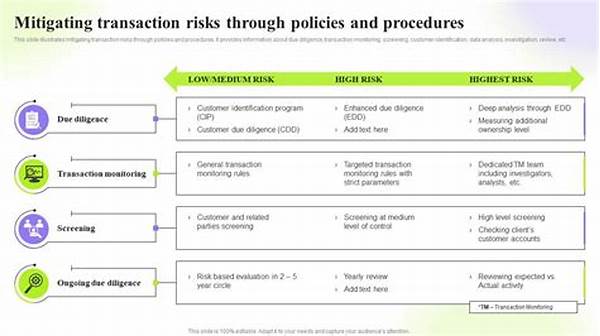

One of the foremost strategies to minimize cryptocurrency transaction fees in wallets is to become familiar with the specific fee schedules and structures of different wallet providers. Some wallets offer customizable fees, allowing users to set a priority level for their transactions. By selecting a lower priority during times of low network congestion, users can reduce costs substantially without sacrificing transaction reliability.

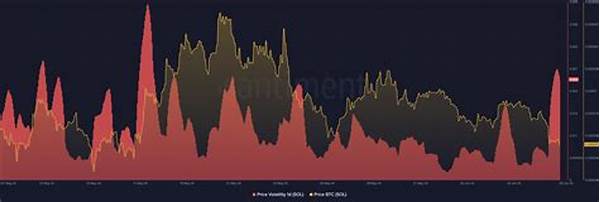

Timing is everything when it comes to reducing cryptocurrency transaction fees in wallets. Monitoring blockchain network activity during different times of the day can give users insight into peak and off-peak hours. Transacting during quieter periods can help in securing lower fees, a technique that savvy users employ to optimize their cryptocurrency transfers.

Additionally, leveraging technological advancements such as off-chain transactions can substantially reduce cryptocurrency transaction fees in wallets. Layer two solutions and payment channels, for instance, allow for near-instant transactions at a fraction of the cost. By keeping abreast of these innovations, cryptocurrency users can greatly benefit from reduced fees and enhanced transaction efficiency.

Advantages of Low Transaction Fees

Understanding cryptocurrency transaction fees in wallets ensures better control over your investments. Lower fees translate into more frequent transactions without significant financial concerns, enabling users to respond quickly to market changes and make timely investment decisions, enhancing overall portfolio performance.

Engaging with wallets that offer low transaction fees empowers users by maximizing the value of their digital assets. When transaction costs are minimized, more funds are available for further investments or withdrawals, translating directly into greater financial freedom and flexibility within the cryptocurrency market.

Another key advantage of optimizing cryptocurrency transaction fees in wallets is enhanced trust and satisfaction. Knowing that you are not overpaying for transactions can provide peace of mind and assurance, supporting a positive user experience and encouraging continued use of digital currencies.

In a competitive market, having an edge is crucial. By mastering cryptocurrency transaction fees in wallets, users gain a critical advantage over those who may overlook these details. This knowledge not only aids in seamless transactions but also fortifies the user’s strategic financial approach within the digital economy.

Read Now : Blockchain Sync Speed Improvement

Finally, adopting efficient strategies for managing cryptocurrency transaction fees in wallets contributes to the broader ecosystem’s health. When users effectively navigate fee structures, blockchain networks can operate more smoothly, ensuring equitable access and reducing network congestion issues for the entire community.

Selecting the Right Wallet for Optimal Fees

Choosing the right wallet can significantly impact your exposure to cryptocurrency transaction fees in wallets. Each wallet has distinct advantages and potential drawbacks in terms of transaction fee structures. Carefully evaluating these aspects when selecting a wallet can save substantial costs over time, ensuring a more efficient cryptocurrency experience.

It’s essential to compare different wallet options, considering factors such as fixed versus dynamic fee settings. While some wallets offer flat fees that remain constant regardless of network load, others adjust fees based on current demand. By understanding these differences, users can make better decisions aligned with their transaction habits and financial goals.

Furthermore, being informed about potential hidden fees or additional charges some wallets may impose can prevent unwelcome surprises down the road. Transparency is a major consideration when choosing a wallet, as it directly correlates to the overall cost-effectiveness of transactions.

The Impact of Cryptocurrency Transaction Fees on Investment

Cryptocurrency transaction fees in wallets play a crucial role in investment strategies. High fees can detract from gains, slowing down the appreciation of your portfolio. Conversely, optimal management of these fees can enhance your returns and streamline your investment process. Recognizing the impact of fees and incorporating them into your strategy is vital for maximizing the efficiency and profitability of your cryptocurrency investments.

For active traders, transaction fees can accumulate rapidly, potentially eroding profits from frequent trades. As such, integrating fee management into investment strategies for cryptocurrencies can make a substantial difference. By selecting wallet services that offer competitive fees, investors can improve their net returns, enabling more agile and informed trading decisions.

Likewise, for long-term holders, minimizing transaction fees ensures that more of their return-on-investment remains intact. Understanding the implications of cryptocurrency transaction fees in wallets can help in planning the timing for withdrawals or repositioning assets, which can significantly affect the overall portfolio performance.

Maintaining Awareness of Fee Structures

The dynamic nature of cryptocurrency transaction fees in wallets requires constant vigilance. Fees can change rapidly based on network conditions and wallet policies, making it essential for users to stay informed. Regularly reviewing your wallet provider’s fee policies and keeping an eye on network trends can prevent unexpected charges and foster more informed financial decisions.

Having current awareness of how fees are structured in your chosen wallet is crucial for managing costs effectively. This knowledge allows for precision in transaction timing, reducing the risk of incurring higher-than-expected fees during periods of increased network congestion.

Moreover, maintaining awareness can facilitate adapting to changes in fee structures, enabling users to quickly switch strategies as needed. This adaptability can lead to significant cost savings and ensures that users are always leveraging the most efficient methods for handling their cryptocurrency transactions.

Conclusion: Navigating Fees for Maximum Benefit

Cryptocurrency transaction fees in wallets, though often overlooked, are a pivotal aspect of managing digital assets effectively. By gaining a deep understanding of these fees, users can enhance their transaction efficiency, ensuring maximum benefit from their cryptocurrency investments. It is not merely about reducing costs but also about strategic financial management that aligns with one’s overall investment goals.

Smart fee management is about embracing all available tools and strategies to control transaction expenses. This proactive approach not only limits unnecessary costs but also enhances users’ ability to respond dynamically to market changes. By continually educating oneself about the intricacies of cryptocurrency transaction fees in wallets, users position themselves for greater success in the digital currency landscape.

In summary, the key to navigating cryptocurrency transaction fees in wallets lies in awareness, strategic planning, and ongoing learning. Staying informed about fee structures, wallet options, and blockchain technology advancements will empower users to optimize their cryptocurrency dealings, ensuring they derive the maximum possible value from every transaction.